The relevance of the DIO metric

What is Days Inventory Outstanding (DIO).

Days Inventory Outstanding (also known as "DIO") is a metric that reveals the average number of days a company holds its inventory before it is sold. The calculation of days of inventory outstanding shows how quickly a company can convert inventory into cash. It is a liquidity measure and also an indicator of a company's operational and financial efficiency. The number of days of stock outstanding is also called "days in stock" or "the stock period.

How is Days Inventory Outstanding calculated?

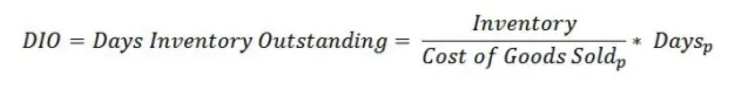

The formula used to determine DIO is relatively simple: divide the average inventory value by the purchase value of sales and multiply it by the period being examined (usually 365 days). The average inventory value is determined by adding the value at the beginning of the period being examined to the value at the end of that period and then dividing the total by 2. In formula form, the calculation looks as follows:

Applications for an online business

Many business owners use Days' Stock Outstanding to refine their product assortment. Suppose you have 5 different product categories or a number of different brands: Then it is possible to determine the DIO per product category, per brand or even at the product level and thus optimize your assortment in terms of cash conversion (i.e. how efficiently you use your company's capital that is "tied up" in inventory).

How do I read the outcome of the DIO metric?

The best way to interpret the results of a Days Inventory Outstanding analysis is to look at the data from similar businesses. That is, in your case, from other e-commerce entrepreneurs. Is your DIO higher or lower, and what does that tell you?

A low DIO indicates that a company can turn its inventory into sales faster. Thus, an e-commerce company with a low DIO is an efficient company in terms of inventory management and sales performance. A high number of days indicates that a company cannot turn its inventory into sales quickly. There can be several reasons for this: poor sales performance or buying too much inventory. Too much inactive inventory is negative for a company because the inventory may eventually become obsolete and (depending on the industry) even unsaleable. Moreover, holding excess inventory also has a negative impact on cash flow and thus on the enterprise value.

Key facts of the DIO

- Days Inventory Outstanding is a measure of inventory management effectiveness and is used to determine how long the company's inventory normally lasts: how long it takes to convert existing inventory into cash.

- Days Inventory Outstanding demonstrates the liquidity of inventory. A short DIO means stock converts to cash faster, while a high DIO shows poor stock liquidity.

- Days Inventory Outstanding should never be compared between different industries because it can vary greatly from one industry to another (compare the greengrocer to the jeweler).

- A lower Days Inventory Outstanding is generally more favorable than a high DIO.

Dropshipping & DIO

With dropshipping, the inventory is held by the supplier and the merchant has no inventory value of his own on the balance sheet. Despite the disadvantages that dropshipping again entails, one could say that dropshipping does entail the perhaps optimal DIO metric.